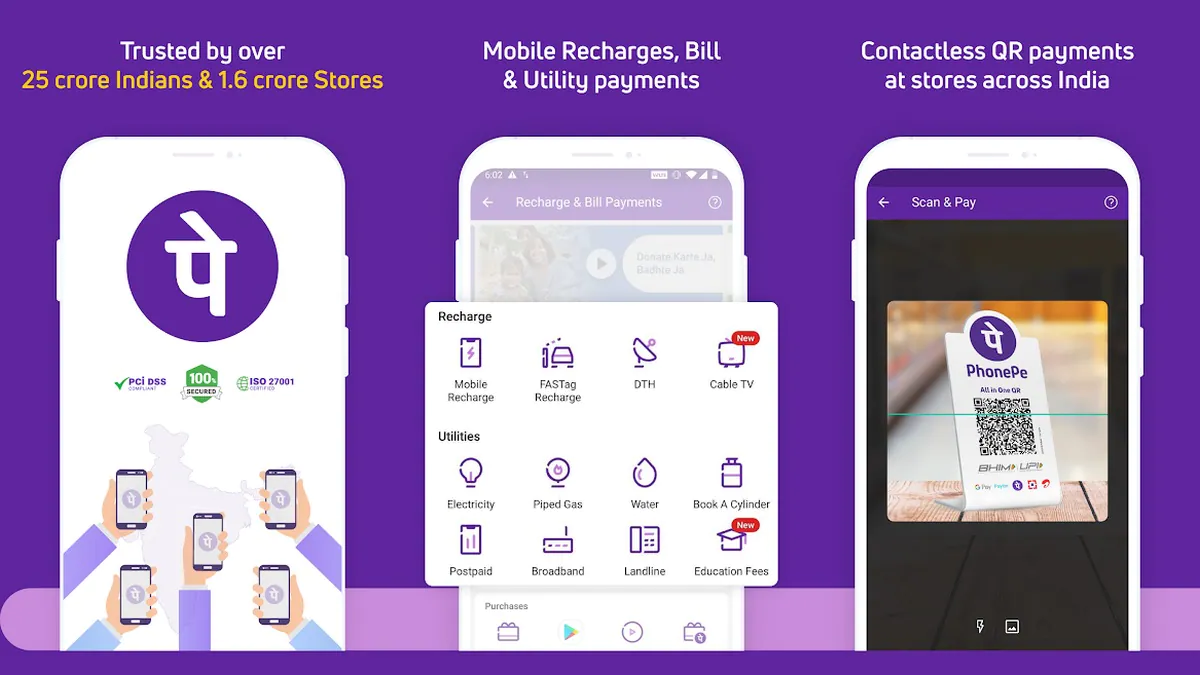

PhonePe may be used to send and receive money, reload mobile phones, DTH, and data cards, and pay for utilities. The firm allows consumers to transfer money between bank accounts without providing any personal information such as bank account or IFSC code. In addition, you may link two bank accounts in one app.

But how to add bank account in PhonePe? To integrate your bank accounts with PhonePe, you must first complete a few procedures. In this article, we will be telling you how to add bank account in PhonePe. Follow this article as it will serve as a guide in how to add bank account in PhonePe.

How To Add Bank Account In PhonePe?

These are the steps for how to add bank account in PhonePe:

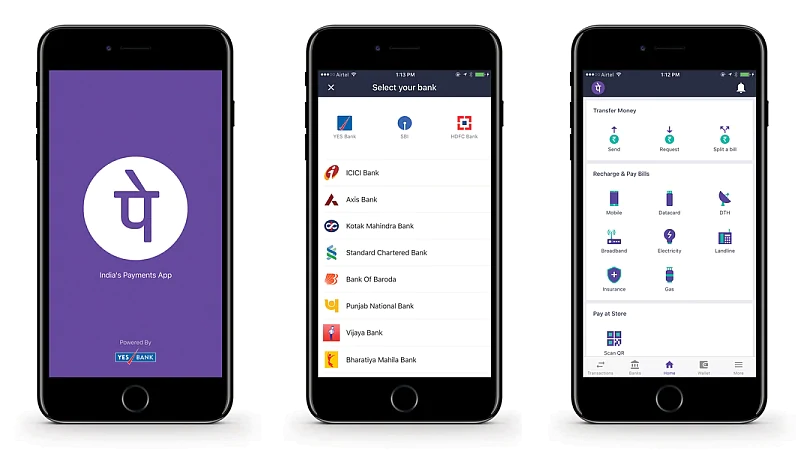

- The very first step of how to add bank account in PhonePe is to open the PhonePe app on your phone and press the symbol in the upper right corner of the screen to access the menu. To add a new bank, go to the Bank Account area and click the ” Add New Bank ” option. PhonePe is based on the UPI payment system. Almost all of India’s major banks support UPI. To send and receive money, PhonePe currently only accepts accounts from UPI-enabled banks.

- From the list of accessible banks, choose the bank you wish to join with PhonePe. If your bank isn’t on the list, you may still link your account manually by clicking the “Link Another Bank” option and inputting the account number and IFSC code. You may receive money but not send money with this account.

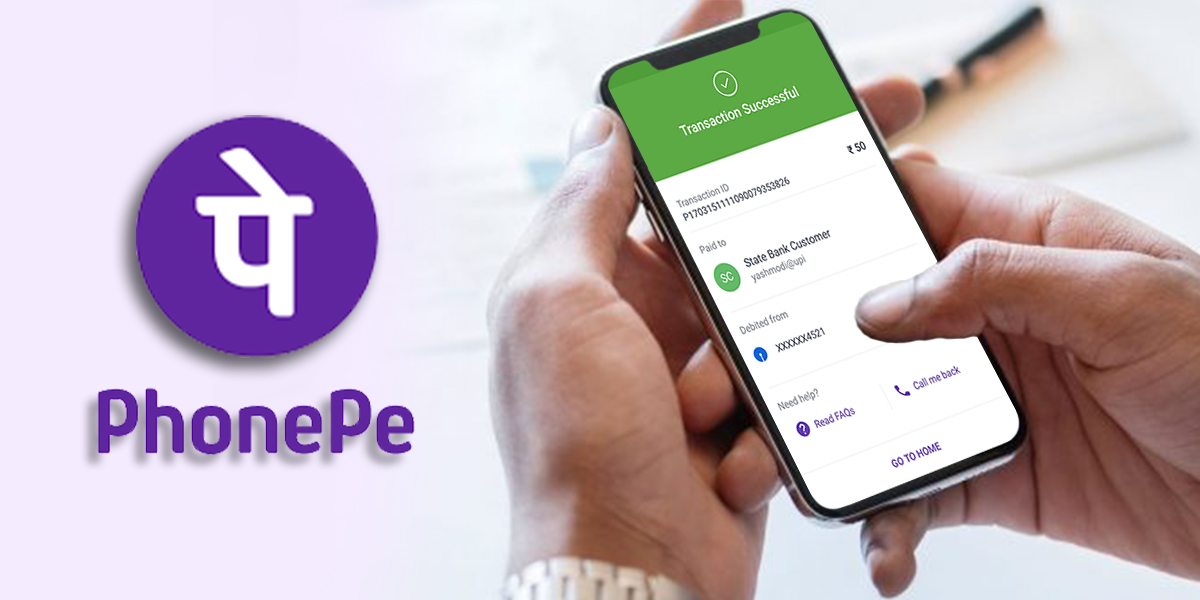

- PhonePe will get your account information and associate it with your account. By pressing on the established UPI PIN button, you may proceed to set up UPI PIN. You may make smooth payments without having to load money into your wallet if you use UPI. You will be sending money from your bank account immediately.

- Enter your Debit or ATM card number’s ” last six digits ” and the ” Expiry Date “. Try inputting 00/49 if your debit card does not have an expiration date. An OTP (one-time password) will be sent to the cellphone number associated with your bank account. Set your UPI PIN using the OTP you received from your bank.

- You have now successfully added your bank account. By authenticating with your UPI PIN, you may transact straight from your bank account. Phonepe allows you to recharge your phone, DTH, Data cards, pay bills, pay merchants, cash transfer, divide bills, and more with just a few clicks. Now you know how to add bank account in PhonePe.

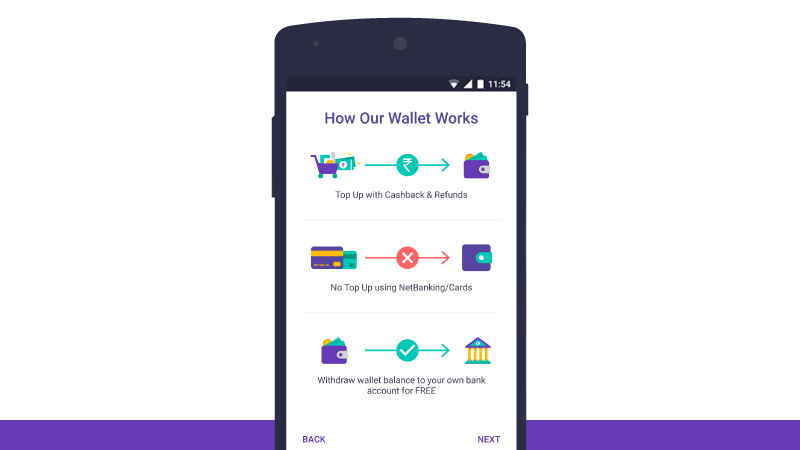

How To Add Money To PhonePe Wallet From Bank

We can effortlessly transfer money from our bank account to our PhonePe Wallet. We may fund PhonePe with money from our bank account, UPI, or bank debit or credit card.

- To begin, open the PhonePe App.

- My Money can be tapped.

- Select PhonePe Wallet from the drop-down menu.

- Choose a payment method after entering the amount.

- UPI, Debit Card, and Credit Card are all options for funding your PhonePe Wallet.

- Finally, make a payment, and the funds will be instantly added to your PhonePe wallet. However, please keep in mind that if you close the app or cancel the transaction right after completing a purchase, you may have issues.

How To Add Another Bank Account In PhonePe

You should always be aware of how to add another bank account in PhonePe. It will help you in long run. Follow the steps given below for knowing how to add another bank account in PhonePe:

- On the PhonePe App, we may add numerous bank accounts. But keep in mind that we can only add bank accounts that are linked to the same phone number. We wanted to clear this before telling you how to add another bank account in PhonePe.

- So, moving ahead to how to add another bank account in PhonePe. The issue is that we’ll have to link the second PhonePe account to a second bank account.

- Open the PhonePe application. Choose My Money and proceed to the next step of how to add another bank account in PhonePe.

- From the Payments tab, choose the Bank Account and proceed to the next step for knowing how to add multiple bank account in PhonePe.

- Click on create a new bank account and choose a bank from the popular bank menu or use the search bar to find a specific bank.

- The details linked with the number will then be immediately retrieved by PhonePe.

So, these were the steps of how to add multiple bank account in PhonePe.

How To Add Bank Account In PhonePe Without Debit Card

Yes, you may add a bank account in PhonePe without a debit card. So, here are the steps of how to add bank account in PhonePe without debit card:

- Open the PhonePe application and choose MY MONEY.

- Next, choose ADD NEW BANK ACCOUNT.

- Type PAYTM PAYMENT BANK into the search field.

- It will immediately get your Paytm Bank account information.

- Your account has now been added to Phone Pe.

Now you may register a Paytm payment bank account without a debit card, and you can also create a Google Pay account using this Paytm payment banking. So, now you know how to add bank account in PhonePe without debit card.

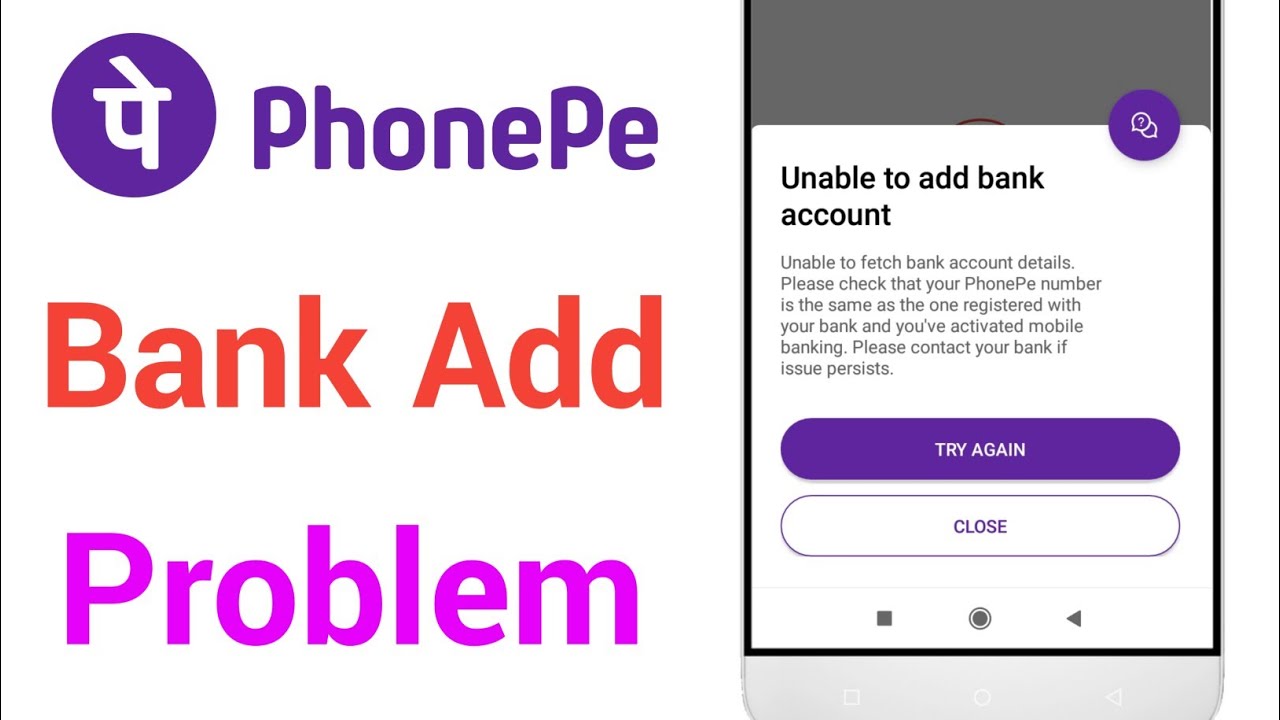

Unable To Add A Bank Account To PhonePay?

You should be aware that applications like PhonePe, Paytm, and Google Pay allow us to make money transfers, check our bank balances, recharge, pay bills, and book tickets. However, PhonePe UPI is required for all of this. We can accomplish anything quickly and simply with this UPI.

UPI has several restrictions, such as the fact that we cannot transmit large sums of money over it. In a single day, we cannot do more than 10 UPI transactions from a single bank’s UPI. In our PhonePe App, we can link many bank accounts together. Keep in mind that in this scenario, we may link all of the banks that are linked to a cell phone.

This, in our view, is because many of us use the same PhonePe App to make many accounts or constantly log out. If you’re having trouble adding a bank account to the PhonePe App, try clearing the data and cache in the app and then reopening it. If it doesn’t work, delete PhonePe and reinstall it. Perhaps your issue will be resolved.

PhonePe Application: Great Features

We already know how to add bank account in PhonePe app. Now we will see why is it used and preferred by so many people:

1. Among India’s First UPI

PhonePe is built on the Unified Payment Interface (UPI) technology, which is sponsored by the government. What exactly is UPI? UPI is based on the IMPS (Immediate Payment Service) infrastructure and allows you to send money between any two bank accounts using unique identifiers such as a cellphone number or a VPA (a unique payment address) instead of account numbers or IFSC codes.

This makes sending and receiving money simple. Simply input a recipient’s cell number/VPA to transfer money directly to his or her bank account!

2. No Need Of Bank Details

Around 30 major institutions, including State Bank of India, HDFC Bank, ICICI Bank, Standard Chartered Bank, and others, have gone live on the UPI platform. When you link your bank account to your PhonePe app, all you have to do is share (and verify) your phone number and bank name, and UPI will obtain account information from your bank through a secure network.

You won’t be able to add your bank account to the PhonePe app if it doesn’t support UPI. Refunds from Flipkart/Myntra, on the other hand, may be deposited into your PhonePe wallet.

3. Uniform Authentication Method

You may transfer and receive money instantaneously using a VPA with the PhonePe UPI app (or Virtual Payment Address). This implies that money can be transferred between any two bank accounts. You may also pay both online and physical shops straight from your bank account.

The greatest thing is that you won’t have to input credit or debit card information, a one-time password, your bank’s IFSC code, or any other personal information.

4. Works Without Wallet Recharge

The PhonePe app also has another feature that you’ll like. You do not need to add money to your wallet. Instead, you may make payments from your bank account using only your cellphone number (which must match the one on file with your bank) or a virtual ID. This means you won’t have to be concerned about running out of wallet balance or having to go through the procedure of filling up your wallet before completing your transaction.

5. Easy Bill Payments

Pay your postpaid and utility bills using your PhonePe app, as well as replenish your prepaid mobile number, data card, and DTH. Enter their phone number, name, or VPA to send or request money from loved ones. After a movie, do you want to divide the popcorn bill with your friends? You can do it as well with the PhonePe app! You may also use QR codes to pay or check your bank account balance.

6. Safe & Secured

You may make free transactions with the PhonePe app. You may now return or exchange your order to Flipkart and get a refund to your PhonePe wallet. You may even deposit your wallet balance directly into your bank account for no additional fee. PhonePe is completely secure and safe.

All transactions are processed over secure banking networks, and the app does not save any user information or passwords. You just need to input your MPIN once for each transaction (which only you know). Never give out your MPIN to anybody for security reasons.

How To Add Bank Account In PhonePe For Easy Transaction

The Google Play Store has already received 5 lakh downloads of Flipkart’s PhonePe app. If you haven’t downloaded it yet, you should do so right immediately! Save more by knowing how to add bank account in PhonePe.